You may have missed the news: there are now tax credits AND rebates available for Homeowners, Home Builders, and even Commercial Building Owners! We’ve provided links throughout the article which will take you directly to the government’s EnergyStar.gov website so you can see these savings are 100% real and available to all qualifying projects!

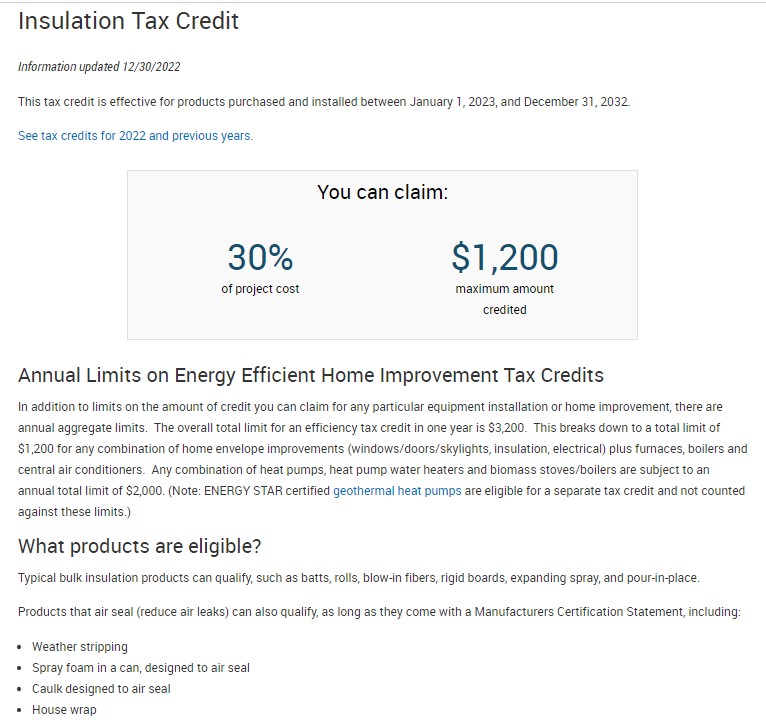

This is a really great time to tune-up your home energy efficiency and save big! For a homeowner purchasing insulation in 2023, you can receive a tax credit of 30%, up to $1200. That means you can tackle a $4000 project and get up to $1200 in tax credit! On top of that, you’ll be saving money on your energy bills every single month and keeping your home more comfortable year-round!

Do keep in mind that there are annual limits on these tax credits. The limit for all tax credits in a single year is $3,200. That means you can take your full insulation tax credit of $1200 and still have approximately $2,000.00 left to save by improving other parts of your home, as well!

Here are links to all the relevant tax credits for Homeowners:

- Insulation: 30%, up to $1200 credit

- Air-Source Heat Pumps: 30%, up to $2000 credit

- Battery Storage Technology: 30% for property placed in service after December 31, 2021, and before January 1, 2033.

- Biomass Stoves: 30%, up to $2000 credit

- Central Air Conditioners: 30%, up to $600 credit

- Electric Panel Upgrade: 30%, up to $600 credit

- Electric Vehicles: Up to $7,500 credit

- Exterior Doors: 30%, up to $500/year ($250/door)

- Fuel Cells (Residential Fuel Cell and Microturbine System): 30% for property placed in service after December 31, 2021, and before January 1, 2033.

- Furnace (Natural Gas, Oil, Propane): 30%, up to $600 credit

- Geothermal Heat Pumps: 30% for property placed in service after December 31, 2021, and before January 1, 2033.

- Heat Pump Water Heaters: 30%, up to $2000 credit

- Home Energy Audit: $150.00

- Hot Water Boilers (Natural Gas, Propane, Oil): 30%, up to $600 credit

- Small Wind Turbines: 30% for property placed in service after December 31, 2021, and before January 1, 2033.

- Solar Energy Systems: 30% for property placed in service after December 31, 2021, and before January 1, 2033.

- Water Heaters (Natural Gas, Oil, Propane): 30%, up to $600 credit

- Windows & Skylights: 30%, up to $600 credit

972-836-4829